Efficient tools for personal tax compliance work

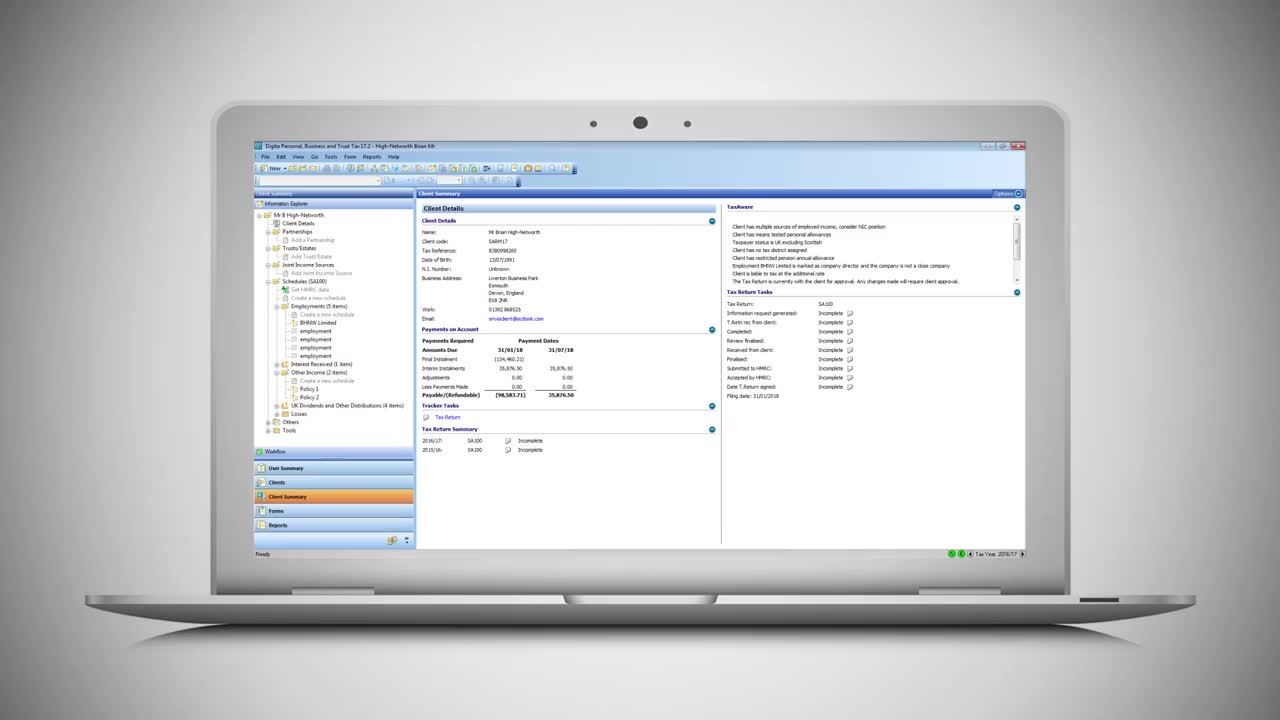

Thousands of firms use Digita Personal Tax software to prepare core compliance forms for self-assessment. Easily submit your clients’ tax returns to HMRC and never miss a deadline.

On top of this, offer value-added services with intelligent tools that keep your data consistent and identify potential savings for your clients. Cut your data entry time, reduce manual errors, and manage risk across your entire practice with our bestselling module.

Download our fact sheet

Why use personal tax return software?

Built-in trackers

Save time with automated trackers that summarise the progress of your work.

In-house tax computation

Verify the accuracy of HMRC tax calculations with this internally developed tax computation tool.

Scenario planning

Offer proactive tax advice by showing your client a "what-if" situation on screen.

Clever alerts

Highlight key areas of interest and identify further fee opportunities using TaxAware.

Data accuracy

Easily compare your client data across the years and create custom reports.

Dividend information

Access the top 100 dividends as standard with the option to buy a comprehensive data feed of UK equity and Unit Trust payments.

Seamless integration

Get the best from Digita Personal Tax with the fully integrated Digita Professional Suite. Our feature-rich software grows with your practice and enables you to better service your clients. Our integration, built around a central database, empowers you to do more with less.

Discover the Digita Professional SuiteRelated resources

The recipe for success

Tracey shares the story of how her Top 30 firm successfully automated their tax process.

Download case study (2 mins read)

Get the facts

Gain a better understanding of the key functionality within our personal tax solution.

Download factsheet (5 mins read)

Frequently asked questions

See helpful answers to common questions — from purchasing through to product support.

Read FAQs (5 min read)GDPR & Making Tax Digital

Together with our Onvio cloud solutions, Digita Personal Tax offers a completely digital tax return process that can help you comply with GDPR. Our HMRC-recognised Making Tax Digital software offers quarterly and end-of-year submissions, and we are part of the HMRC MTD for the Income Tax testing phase for 2025 to 2026.

GDPR complianceMaking Tax Digital software

We power UK tax and accounting firms with scalable software and a commitment to working side by side with our customers. Every customer receives a dedicated account manager, telephone support, and comprehensive e-learning to build confidence and capability. Our expert Professional Services team ensures a smooth, stress-free experience from setup to optimisation — so you can focus on delivering results.

Questions about our products and services? We’re here to support you.

Contact our team to learn more about our tax and accounting solutions.

Contact us (Accountancy Practices)Contact us (Corporations)