Tax Professionals 2022 Report: Talent

29 April 2022 - 15 min read

SECTION 1: STRATEGIC PRIORITIES

At the start of 2021, tax professionals were emerging from the pandemic survival mode and hoping the new year would allow them to return to some semblance of normality. After all, most accounting firms had adapted quite well to remote work, and expectations were that the economy would start to recover in 2021.

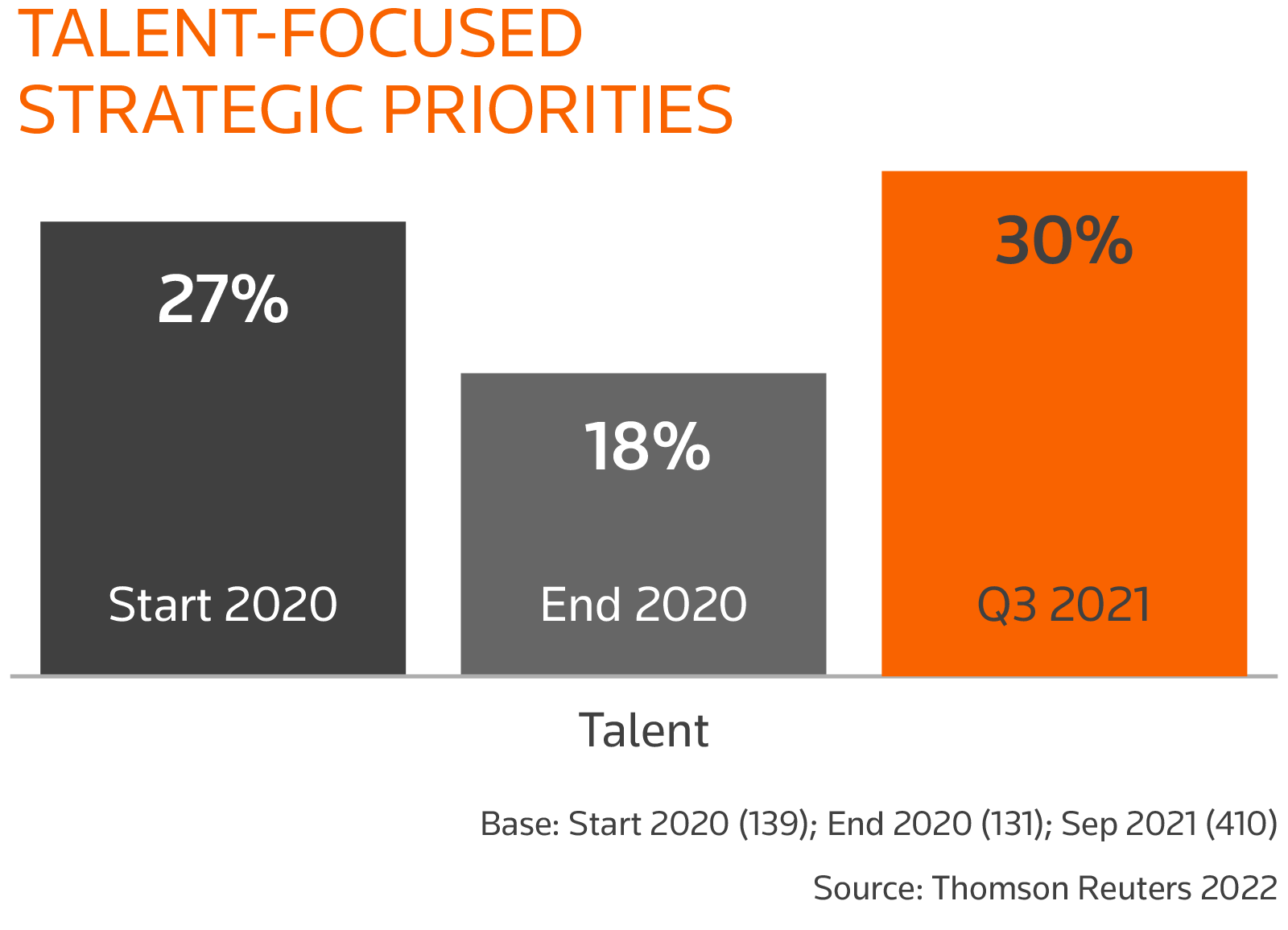

Interestingly, as 2021 progressed and tax professionals grew more accustomed to working hybrid schedules, their priorities shifted. Prior to the pandemic, tax leaders were focused primarily on growing their businesses. In September, however, while respondents were still focused on growth, it had been overtaken in priority by a concern about recruiting and training of new and existing talent. Personnel development was especially important in firms with four or more people, but that desire also extended to individuals eager to improve their own skills.

Going into the last three months of 2021, the strategic priorities for tax advisors were centred around these general themes:

- Talent — attracting and recruiting new people; developing and retaining existing talent

- Growth — increasing revenue and attracting new clients

- Efficiency — streamlining processes and leveraging technology to increase productivity

- Client Service — offering more strategic business advice, better response times, and more effective communication

In this year’s survey, differences of emphasis will of course depend upon the size of a firm and the actual roles respondents play in their organisations. Continued growth did bounce back as a strategic priority after dipping somewhat during the pandemic, and squeezing more efficiency out of processes and technologies is never far from management’s mind. Further, uncertainties exposed by the pandemic appear to have prompted a re-dedication to both excellence in client services and tax planning.

Priority 1: Talent

During most of 2020 and into early 2021, talent recruitment and development were pushed to the back burner while tax and accounting firms scrambled to adapt to the changing circumstances brought on by the pandemic. By the third quarter of 2021, however, the need for skilled tax professionals reasserted itself and, in our survey, almost one-third of firms

with more than four employees cited the search for — and development of — quality talent as their top priority.

While the need for skilled workers was a common concern, the reasons behind it depended largely on whether the respondent had a leadership role in the firm or not. For

example, non-owner/managers with a leadership role mainly wanted highly skilled people to support development of their team. On the other hand, those in non-leadership roles expressed a strong desire to continue their own learning and development — to “be the best I can be” — presumably to bring more value to the enterprise, raise their stature in the firm, and make more money. Meanwhile, firm owners and solo practitioners were less concerned about developing their own skills than they were about applying those skills to provide better service for their clients.

Recruitment

In the hunt for talent, finding people with the right skillset is never easy, but our survey revealed that some skills are much more in demand at the moment than others.

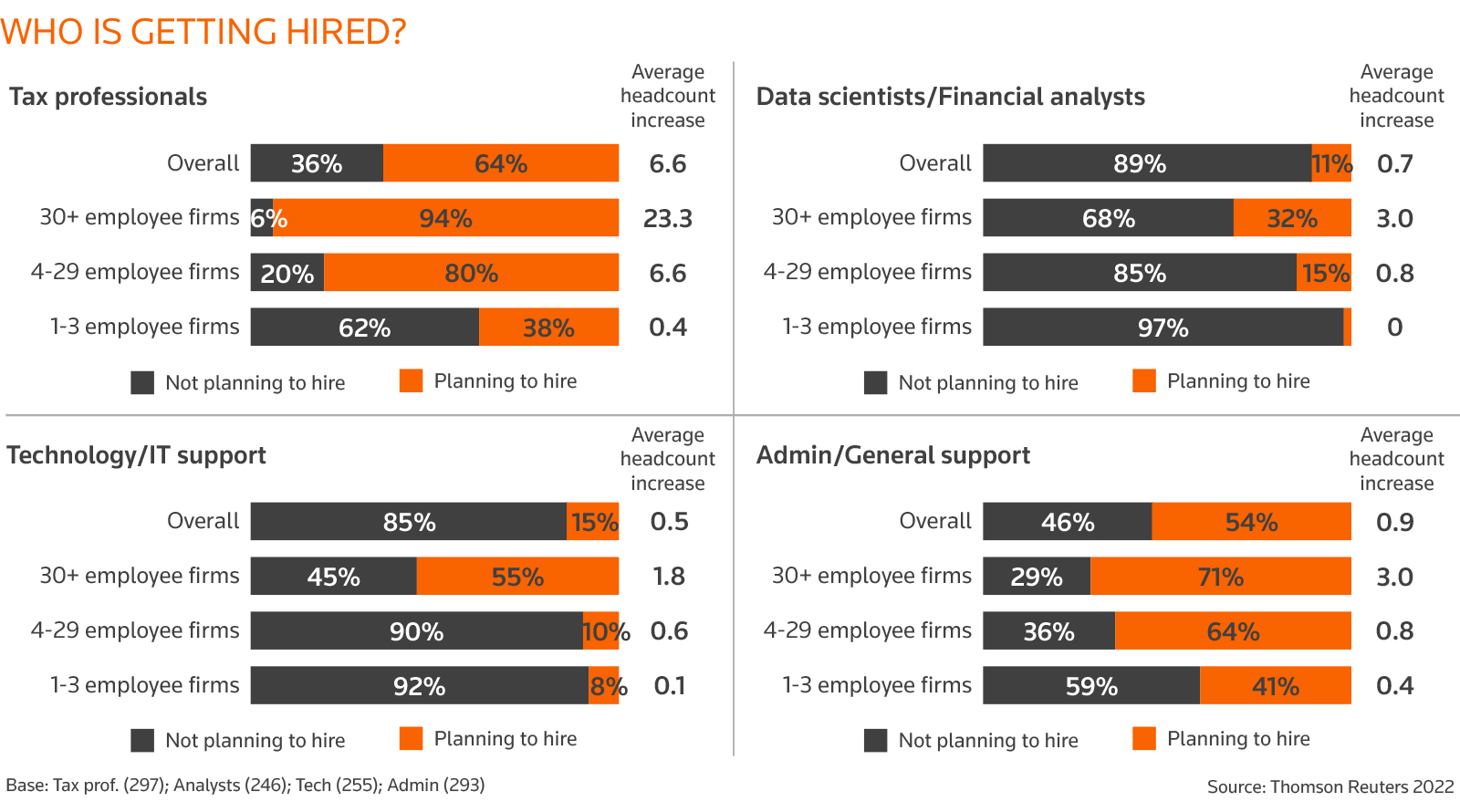

In general, the need for tax professionals and administrative support far outweighed the need for data scientists, financial analysts, and IT support. Overall, 64% of firms said they intended to hire tax professionals in the coming year, with an average headcount increase of 6.6 tax professionals. In firms with 30 or more employees, however, a whopping 94% said they planned to hire an average of 23.3 additional tax professionals. And 80% of firms with between 4 and 29 employees said tax professionals were at the top of their hiring wish list, while even 38% of the smallest firms — those with between 1 and 3 employees — said adding another tax pro was part of their plan.

General administrative support is another area in high demand, our survey showed, as 71% of firms employing more than 30 employees said they plan to hire an average of three new administrators, and 64% of firms with between 4 and 29 employees indicated a desire to add at least one more person to their support staff.

At the other end of the spectrum, it appears that data scientists, financial analysts, and IT personnel are going to be fighting over a relatively small number of jobs at the larger firms. More than half (55%) of firms with 30 or more employees said they intended to add an average of one or two people to their IT support staff, while less than one-third of the same firms said adding a few data/financial analysts was in the cards.

Skills development

Closely related to the search for talent is the development of skills for new and existing tax professionals. The question becomes then, which combination of personal qualities and professional skills do tax firms find most desirable? And which qualities and skills should people focus on improving if they want to advance their careers?

As for the personal qualities, an aspiring tax advisor should cultivate and firms should seek to develop business knowledge and tax expertise, both of which were ranked the highest in our survey, followed by dedication to client service and overall communication skills.

In order of importance, the top 10 qualities of a standout tax advisor were identified as:

- Knowledge/expertise

- Commitment to client service

- Communication skills

- Top quality work

- Dedication to the client’s success

- Timeliness/dependability

- Social skills

- Ability/inclination to be proactive

- Responsiveness

- Ability to speak/write in plain language

In terms of skills that are increasingly important for a top tax advisor to have in today’s changing world, our survey respondents most commonly identified technology as increasing in importance, followed by keeping up-to-date with tax changes and, again, communication.

In order of importance, the range of skills necessary to be a superior tax advisor are:

- Technology skills (e.g., ERP/tax software, data analysis)

- Staying current with changes in the tax code

- Communication (oral, written, and interpersonal)

- Overall tax knowledge

- Soft skills/EQ/leadership

- Scouting/horizon scanning

- Risk management

- Adaptability

- Specialist expertise (e.g., audit, forensics, international)

- Business partner/team player

The ideal tax advisor

Yet, if you combine the personal attributes and skills necessary to be a top tax advisor, you get an ideal tax advisor, which is someone who:

- has demonstrable knowledge and experience

- pays attention to changes in the tax code

- knows how to use tax technology to be more productive, accurate, and efficient

- is dedicated to serving client needs

- has the communication skills to explain tax strategies to clients

- can interact productively with colleagues

- delivers high-quality work in a timely manner

In general, these attributes reflect a shift in emphasis from metrics of pure productivity to a more well-rounded approach that puts the client front and center. In fact, when firm leaders were asked about the standout qualities that they are looking for in a tax advisor, more than four-times as many people rated “client service” as a desired key quality in 2021 than in 2020, and more than twice as many cited “social skills.”

Engagement and job satisfaction

While it is important to understand what companies are looking for in a competent tax professional, it is equally important to understand what those professionals working in the tax field value in their employers, their jobs, and the tax profession in general. This information is important to employers as well because job satisfaction is a key component of employee retention, which itself is essential for building a strong company culture.

We asked three types of tax professionals to identify the aspects of their jobs that they like the most, and which parts they would like to change or improve in order to increase their job satisfaction.

The three job categories were:

- solo practitioners and firm owners

- management positions with a leadership role

- employees in a firm with a non-leadership role

Interestingly, all had different ideas about what was most important to them, and what could be done to make their working lives more enjoyable and rewarding.

Solo practitioners/owners

Tax professionals who own their firm or work alone greatly value the ability to work for themselves — to be their own boss — and the flexibility to work when and how they want. However, long hours and a relentless workload often put their work/life balance at the top of their list of aspects of their job that they’d like to see improve. Firm owners would also like to recruit and attract higher-quality talent, and all agree that more investment in better technology would (or at least could) make their jobs more manageable.

Managers/leaders

Those with leadership roles in a firm setting said they value their company culture and colleagues, but also enjoy interacting with clients, as well as the personal flexibility and decision-making power that comes with a leadership position. However, non-owner leaders also work the longest hours — an average of more than 60 hours per week in the U.S. — so they too harbor a desire for more work/life balance.

Leaders also say their jobs could be improved by recruiting and attracting more quality talent, which would result in a stronger team and, presumably, better performance and the ability to gain higherquality work. Better internal communication is also on their job-improvement wish list, as is additional investment in more robust technology. Confidence in the firm’s overall leadership and direction was also cited as a strong driver of job satisfaction.

Non-leaders

Tax advisors and administrators without a leadership role tend to like the people they work with and value their company culture. Confidence in the firm’s leadership and direction are also important factors. When they are treated with respect and given opportunities to grow professionally, non-leaders tend to register relatively high in job satisfaction. For the most part, non-leaders also value having a more favorable work/life balance than some of their more stressed-out leaders, but they also indicate that their work/life balance is far from ideal, especially during tax season. Better pay and more capable colleagues would also help make their lives more enjoyable.

Work/life balance and well-being

Given that tax professionals at all levels in our survey say they would enjoy their careers more if they had a better work/life balance, we asked tax advisors to share how many hours they are really working, and whether their long hours have resulted in any significant physical or mental health issues.

These results are particularly important for firm leaders and human resources managers, because over-worked employees may boost productivity in the short term, but they can also cost

a company in several other ways. Physically and mentally unhealthy employees not only drive up health-insurance costs, they are more likely to make mistakes on the job, feel resentment toward their employers, experience low morale and/or burnout, and quit or leave their jobs.

By contrast, a healthy company culture drives productivity by maximising “good” hours, providing ample recovery time, offering opportunities for personal and professional growth, and creating a general atmosphere of support and respect for all employees.

Hours behind the desk

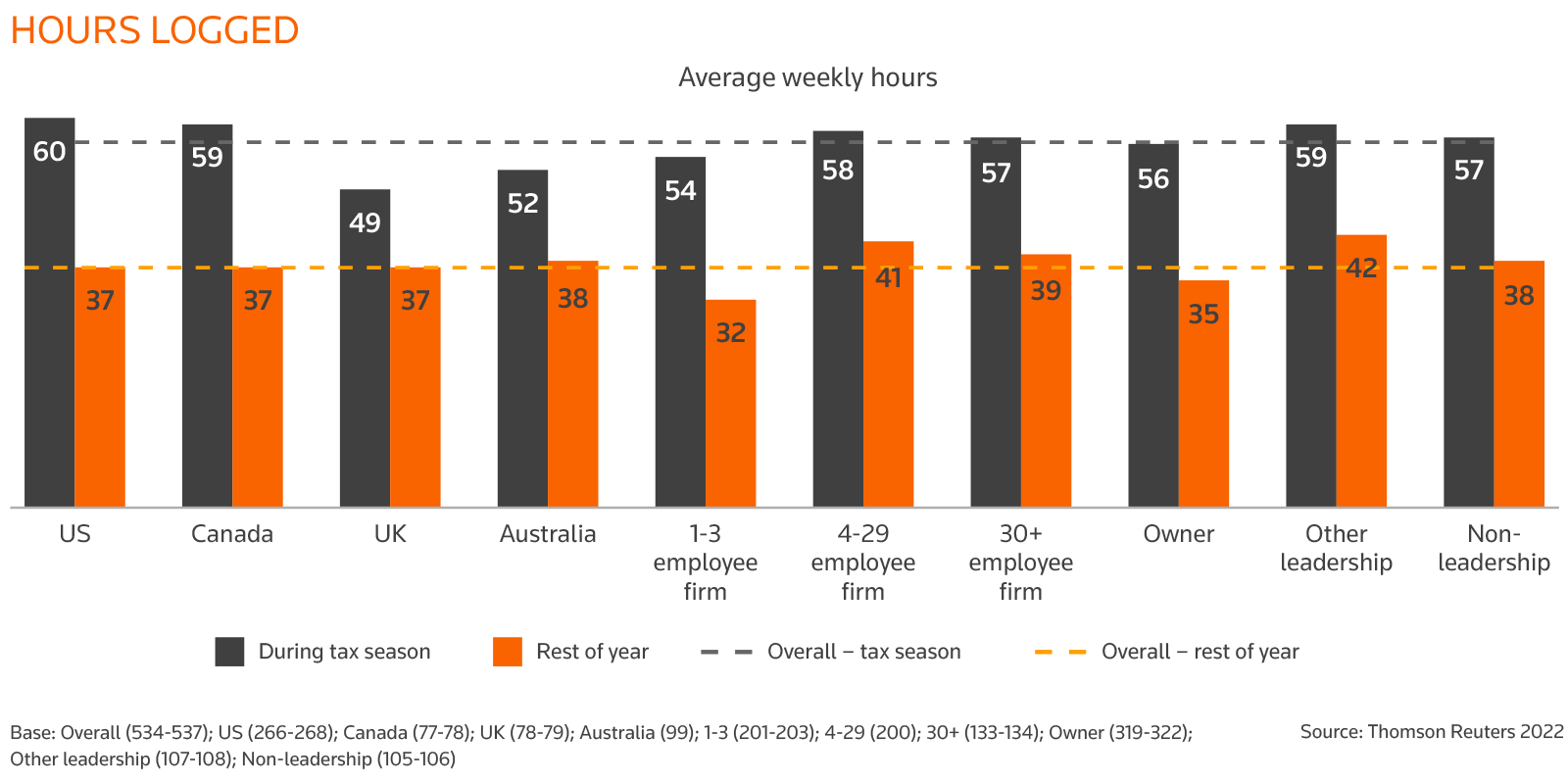

In the U.S., “tax season” — traditionally, from January 1 to April 15 — is when tax professionals grit their teeth and log an average of 60 hours or more per week on the job, with many working 70 or more hours. Tax advisors in Canada experience a similar spike in hours logged, but in both countries their workload the rest of the year returns to a more manageable average of 37 hours per week (39 hours per week in firms with 30 or more employees; 41 hours per week in firms with between 4 and 29 employees; and a relatively leisurely 32 hours per week in firms with 1 to 3 employees).

Interestingly, tax advisors in the U.K. and Australia report working roughly the same number of regular hours as their U.S. and Canadian counterparts, but their workload during tax season only spikes to an average of 49 and 52 hours respectively, due most likely to different work cultures as well as different timescales for filing taxes.

In all countries, owners and solo proprietors tend to work the least number of hours (56 hours per week during tax season, 35 hours the rest of year), although the variance is wide because some owner/solo proprietors choose to work part time, and some do in fact work longer hours.

Non-owner manager/leaders tend to work the most hours (59 hours or more during tax season, 42 hours the rest of year), and non-leaders land somewhere in between (57 hours during tax season, and 38 the rest of year).

Impact on physical/mental health

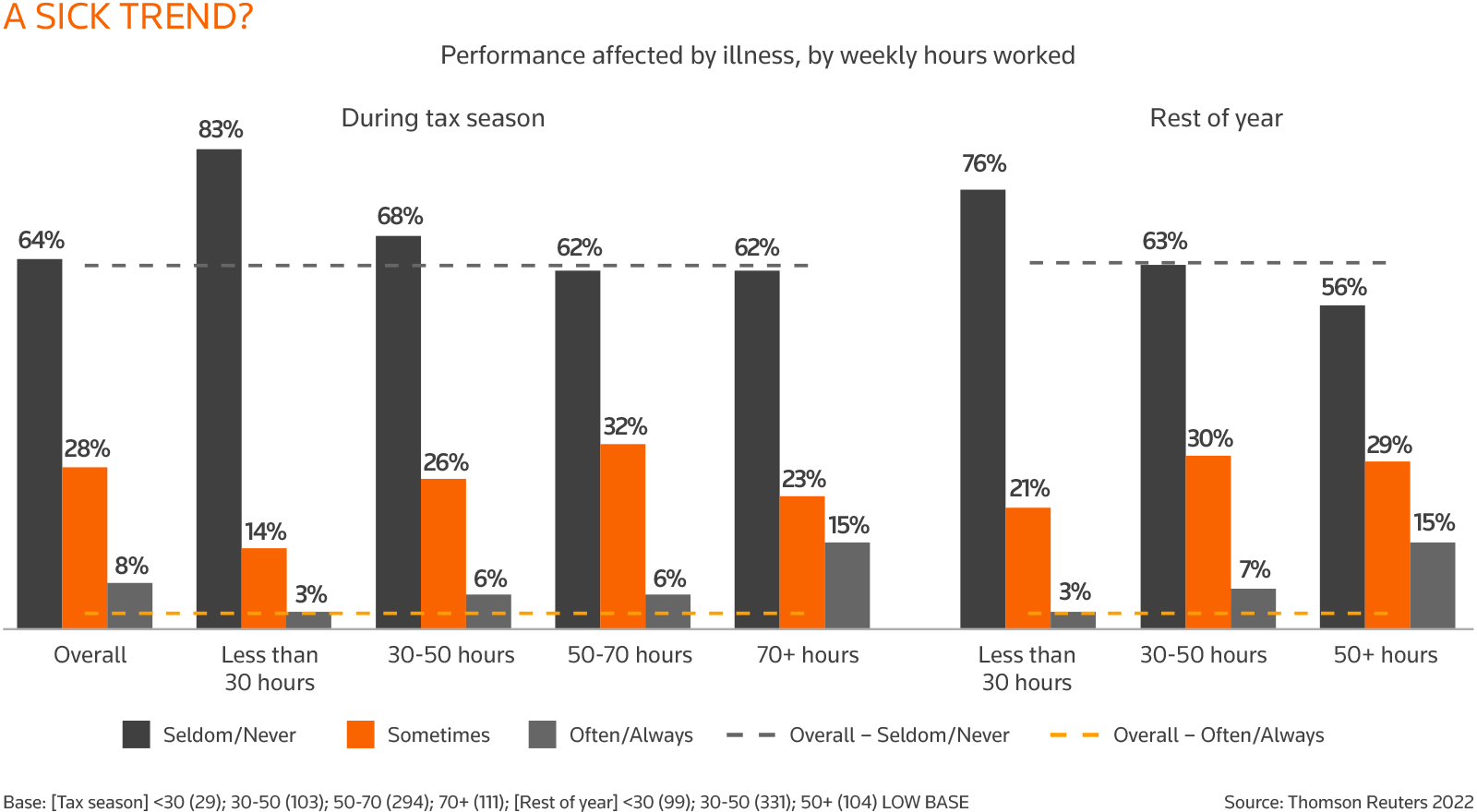

Many factors can affect a person’s physical or mental health, of course, but long hours in the tax profession can certainly take a significant toll. During tax season, almost one-third (32%) of workers who logged 50 to 70 hours per week reported experiencing health issues at least some of the time, and 15% were affected by one health issue or another “often” or “always.”

Tax season per se isn’t necessarily the culprit behind ill health, but because people who said they work 50 or more hours the rest of the year reported almost identical levels of illness.

Further, those who work 30 to 50 hours per week and those who put in 50 to 70 hours experienced roughly the same number of health issues, with 6% saying that full-time hours almost always had a negative impact on their health, and roughly one-third saying it occasionally affected them.

During tax season or not, the only cohort that reported relatively few health-related performance issues were those who worked less than 30 hours per week, with 83% of these part-timers saying they seldom or never have health issues that affect their performance, and only 3% reported a constant or recurring health issue related to work.

Country

The country in which you happen to work in also makes a difference, although not always in the ways one might expect. For example, 39% of tax advisors in the U.K. said health issues sometimes affect their work performance. 10% of U.S. tax professionals report being frequently or always affected by some sort of physical or mental illness, and 22% said they were “sometimes” affected.

In Canada, fewer workers (5%) said their performance was affected by health issues “often or always,” but more (31%) had occasional problems. Whereas in Australia, almost one-third (32%) of respondents said they sometimes experienced work-impairing health issues.

Firm size

The size of one’s firm may also be a health factor for some. Overall, firms with between 4 and 29 employees reported having the most health problems, with 32% “sometimes” experiencing health issues, and 11% experiencing them “often or always.” In firms with 30 or more employees, however, the “often/always” group dropped to 4%. And again, manager/leaders — the clear workhorses of the accounting profession — experienced the highest number of health-related

issues at 9%.

Still, for most tax pros there’s no getting around extra hours during tax season. Tax professionals work an average of 37 hours per week most of the year, but crank it up to 57 hours — or 20 additional hours per week, or roughly a 55% increase in hours worked — during tax season.

Summing up the work situation in all too many firms, one of our survey respondents noted: “Public accounting firms need the right staff and the right amount of staff. The days of 70-plus-hour weeks should be a thing of the past… . If we staff and schedule correctly, everyone should be able to drop their hours significantly.”

CONCLUSION

As economies around the world slowly recover from the pandemic’s persistent shock waves, tax professionals are well-positioned to provide the range of services and guidance their

clients will need in 2022 and beyond. Wisely, tax leaders are taking this opportunity to reassess their priorities and remind themselves that investing in top-quality talent and supporting the professional growth of their employees is essential to the health and well-being of both the business and its workers.

The pandemic appears to have prompted a long-overdue re-evaluation of what it means to be an effective tax advisor and how important a loyal, well-trained team of tax professionals

is to a firm’s overall resilience and viability. It may be a bit too early to call this a revolution, but a renewed emphasis on recruiting and developing a firm’s human capital suggests that

at least some tax leaders recognise the inescapable connection between people and profit, and are taking steps to show valued employees that they are not — and should not be —

taken for granted.

Though most of the work at small to midsize accounting firms still involves processing tax returns for individuals and businesses, the trend toward offering a broader range of business

advisory services is taking hold at all levels, primarily because clients are begging for it. A whopping 95% of this survey’s respondents said their clients are asking for more tax planning, business, and financial advice, and that means that the door of opportunity is wide open for those firms that are willing to walk through it.

Get your Tax Professionals 2022 Full Report

Don't miss this full report that provides insights and guidance on all 4 top priorities for tax professionals and link to https://tax.thomsonreuters.co.uk/downloads/reports/tax-professionals-2022-report

Download Special Report PDF - 1,020KB